The Honest Guide to Crypto Pump-and-Dump Schemes

- Bitcoinsguide.org

- Jun 13

- 2 min read

How to Spot, Avoid, and Outsmart Market Manipulation

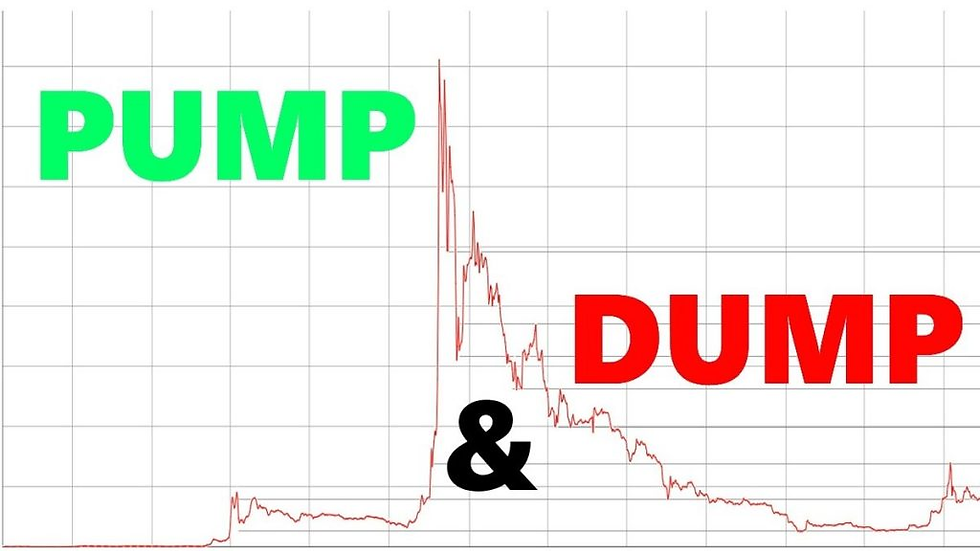

Pump-and-Dump Schemes in Crypto: A Real Risk for New Investors

Crypto markets can skyrocket overnight—but not all pumps are organic.

In many cases, price surges are artificially driven by coordinated groups or insiders looking to cash out on your FOMO.

This guide breaks down how pump-and-dump schemes work, how to detect them early, and what to do to protect your portfolio from being used as exit liquidity.

What Is a Pump-and-Dump Scheme?

A pump-and-dump involves inflating the price of a token using hype, misleading promotions, or insider manipulation, only to sell once others buy in—causing the price to collapse.

It’s a form of market manipulation, often found in:

Low-cap meme coins

Newly launched tokens on DEXs

Telegram/Discord “alpha” groups

Common Red Flags to Watch For

Identifying suspicious activity early is the best defense. Here’s what to look for:

🚩 Sudden price and volume spikes without real news

🚩 Anonymous dev teams or no official website

🚩 Buzzwords like “next 100x gem” or “don’t miss this launch!”

🚩 Liquidity pools that can be pulled or drained

🚩 Wallets holding 30%+ of the total supply

Tools to Analyze Tokens

Before you invest, do a basic security check using:

DexTools / DexScreener – Monitor trading activity and volume

Etherscan – View top token holders and suspicious transfers

TokenSniffer – Analyze contract safety, liquidity locks, and fees

GoPlus / RugDoc – Scan smart contracts for scam patterns

How to Stay Safe

Protecting your capital means staying skeptical and informed.

✅ Only invest in tokens with public teams and real use cases

✅ Avoid hype-driven Telegram calls or anonymous influencers

✅ Don’t chase vertical green candles—it's often too late

✅ Limit microcap exposure and always use stop-losses

✅ Look for audits, whitepapers, and on-chain transparency

If you’re hearing about a token after a 500% pump—you’re the product, not the winner.

Is It Illegal?

In regulated markets, yes. In crypto, enforcement is limited—but improving.

Expect tighter global laws on market manipulation in the coming years, especially as DeFi continues to grow.

Final Thoughts

Pump-and-dumps are a reality of early crypto. But knowledge is your best defense.

Learn the signs. Use the tools. Think long-term. And don’t let hype rob you of your capital.

🟩 Stay one step ahead

Get honest crypto guides, tools & insights every week at BitcoinsGuide.org – no hype, just signal.

Comments